GSS: Why is it easier to have negative interest rates with electronic money vs paper? Also can you explain how this would work with a currency like bitcoin vs. "electronic dollars"?

Miles Kimball: It is easy to have negative interest rates for money in the bank: the number for the balance in the account gradually goes down if nothing is put in or taken out. Because paper money has a particular number written on it, getting a negative or positive interest rate for papercurrency requires a little more engineering. And that engineering involves having the e-dollar be the unit of account.

If the paper dollar were the unit of account, then the interest rate for paper currency is always zero (unless you have a system of directly taxing paper currency, which is administratively burdensome and politically much more difficult than an electronic money system). So to have negative interest rates on paper currency as well as in other assets, the e-dollar needs to be the unit of account.

“[I]t is fine to have private cryptocurrencies perform the medium-of-exchange and store-of-value functions of money […].”

With the e-dollar as the unit of account, everything the central bank needs to do to have a nonzero paper currency interest rate can be done at the central bank's cash window where banks come to deposit or withdraw paper currency from the central bank.

For good monetary policy, it is important that the central bank have control over the unit of account. And this e-dollar unit of account might have many of the aspects of a cryptocurrency--perhaps enough that it can be considered a cryptocurrency.

As far as private cryptocurrencies (like bitcoin) go, it is fine to have private cryptocurrencies perform the medium-of-exchange and store-of-value functions of money, but monetary policy requires control over the unit of account. So central banks need to retain control over the type of money that defines the unit of account--in this case the e-dollar.

Under an electronic money policy, 3 key things will insure that the e-dollar (or e-euro or e-yen or e-pound etc.) is the unit of account:

- a requirement that taxes be calculated in e-dollars.

- accounting standards that require accounting to be done in e-dollars.

- the kind of need for coordination between businesses and between businesses and households that leads people to do daylight savings time (without any intrusive inspections of someone coming to look at your clocks).

“To have negative interest rates in a cryptocurrency system […] there should be a separation between the unit of account and the medium of exchange.”

GSS: How can you have negative interest rates in a cryptocurrency system?

MK: To have negative interest rates in a cryptocurrency system that uses bitcoin, say, for most transactions, there should be a separation between the unit of account and the medium of exchange.

Having an e-dollar that is distinct from a bitcoin is the way to do this. (Also, it is good to have many different stores of value. But that always happens.)

Currently, robots cannot do monetary policy as well as central banks can. Someday maybe they will be able to. Then a robot can be put in charge of the e-dollar. But there would still need to be a separation between the e-dollar unit of account (controlled by a robot) and anything that mechanically has a zero interest rate stated in terms of itself (as bitcoin now does).

GSS: What are your thoughts on bitcoins ability to be a currency? What are its limits from your perspective?

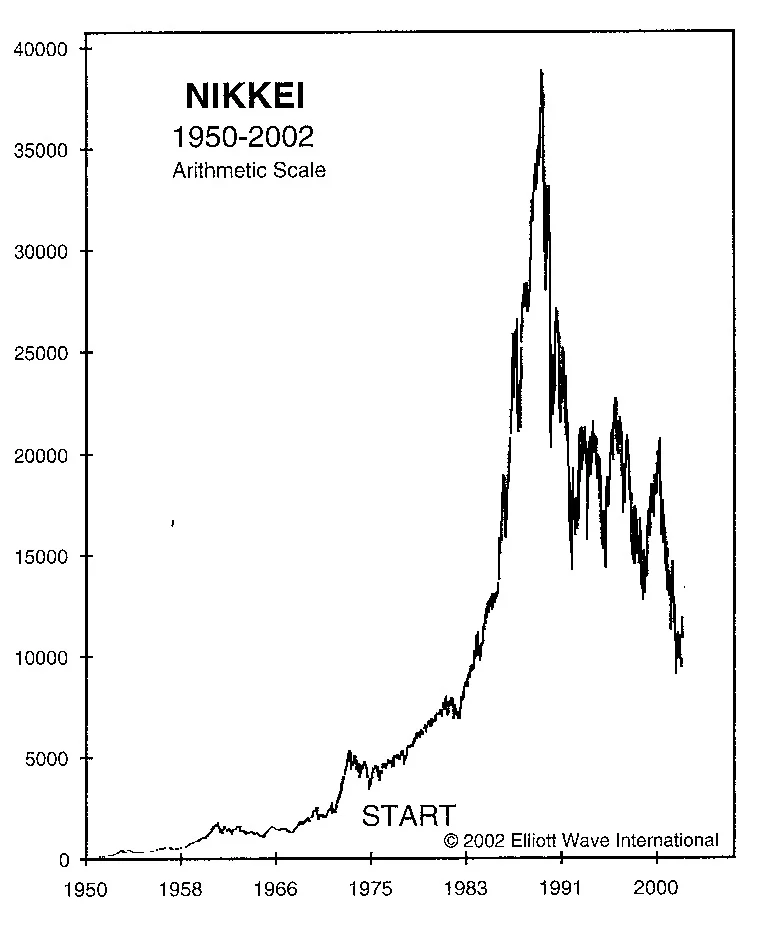

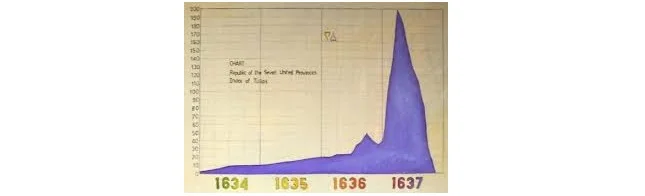

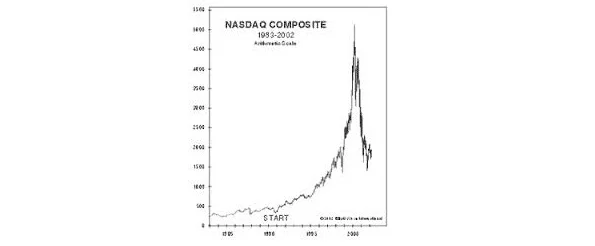

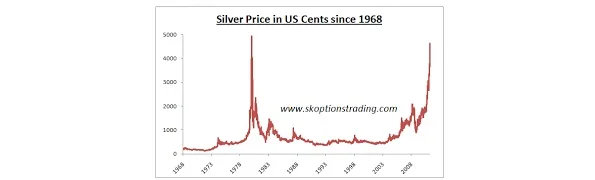

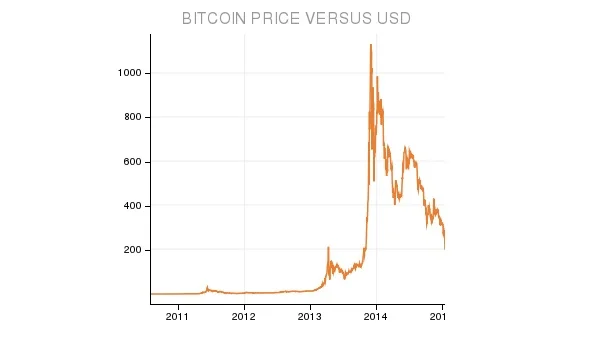

MK: Bitcoin is a currency already. But it would not be good to try to use it as a "full-service" currency. A good unit of account needs to have a constant value relative to goods and services. Bitcoin does not do this. And it cannot keep a constant value relative to goods and services without a much, much, more sophisticated algorithm for controlling the supply of bitcoins that would rival in complexity (and exceed in quality) what central banks now do. Good monetary policy is not easy.

“Central banks (which are humans assisted by computers) still do a much, much better job at monetary policy than the bitcoin algorithm would.”

The unit of account should be under the control of the institution that does the best job at keeping the value of the unit account constantly relative to goods and services--and in the process, keeps the economy at its natural level of output.

Currently, that is central banks. Bitcoin's value fluctuates wildly relative to goods and services. Central banks (which are humans assisted by computers) still do a much, much better job at monetary policy than the bitcoin algorithm would.

GSS: Also if you could talk more about blockchain technology and central banks? What type of tools/operations would be best suited for a blockchain?

MK: I am not a technical expert on blockchains, but I think blockchains or technical advances inspired by blockchains will be important in making e-dollars work as well as possible. Electronic dollars include money in the bank, but its being done in a very inefficient way, and transaction costs are huge, banks need to go the way of bitcoin. Blockchain technology is a great advance because it can do it much more cheaply than how the current banking system handles transactions now. It will make electronic transactions will be much more meaningful.

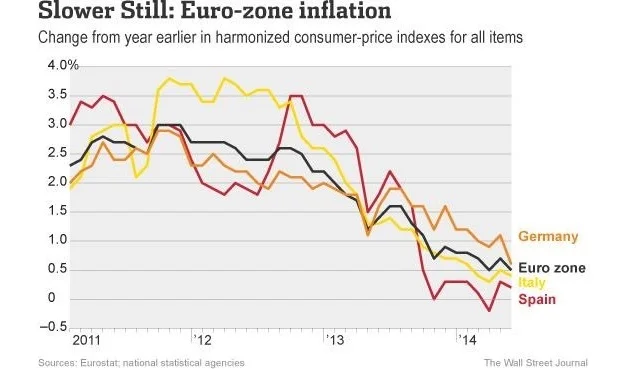

GSS: Do you have any thoughts on the "currency wars" and their impact on central bank policies? Do negative interest rates have anything to do with this?

MK: Talk of "currency wars" is mostly silly. If all countries do expansionary monetary policy, that is not a currency war, that is a global monetary expansion not a currency war. If every time you read about a "currency war,” you substituted the words "global monetary expansion," you would not go far wrong.

The only case when the word "currency war" is justified is when countries are each doing currency interventions by selling their own assets and buying equivalent foreign assets. If all countries do this, it all cancels out, and things are back to square one.

As long as each country or its central bank is purchasing assets that have a higher interest rate or rate of return than the assets they are selling, it is a monetary expansion, not a salvo in acurrency war.

Of course, monetary expansions have an effect on exchange rates, but if another country is not happy with that effect on its exchange rate, it should just match with its own, appropriately calibrated monetary expansion. That response is not a response in a "currency war," it is normal monetary policy.

“[B]eing able to do negative interest rates makes it possible to nip recessions in the bud.”