Bitcoin Price Analysis: One Strong Bear (Week of June 7)

Price at the time this article was written was: US$225.00

Last week’s article began with:

“The price has broken below some significant levels and looks like it's going to test some very important levels below. The 50-day EMA has been a massive wall and it looks like the price has run out of energy trying to get and stay above it. Now a big test is coming, as price has broken below US$231, which has been mentioned in many previous articles as an area that needed to hold. Look for US$220 and the massive support area of US$210 to be tested.”

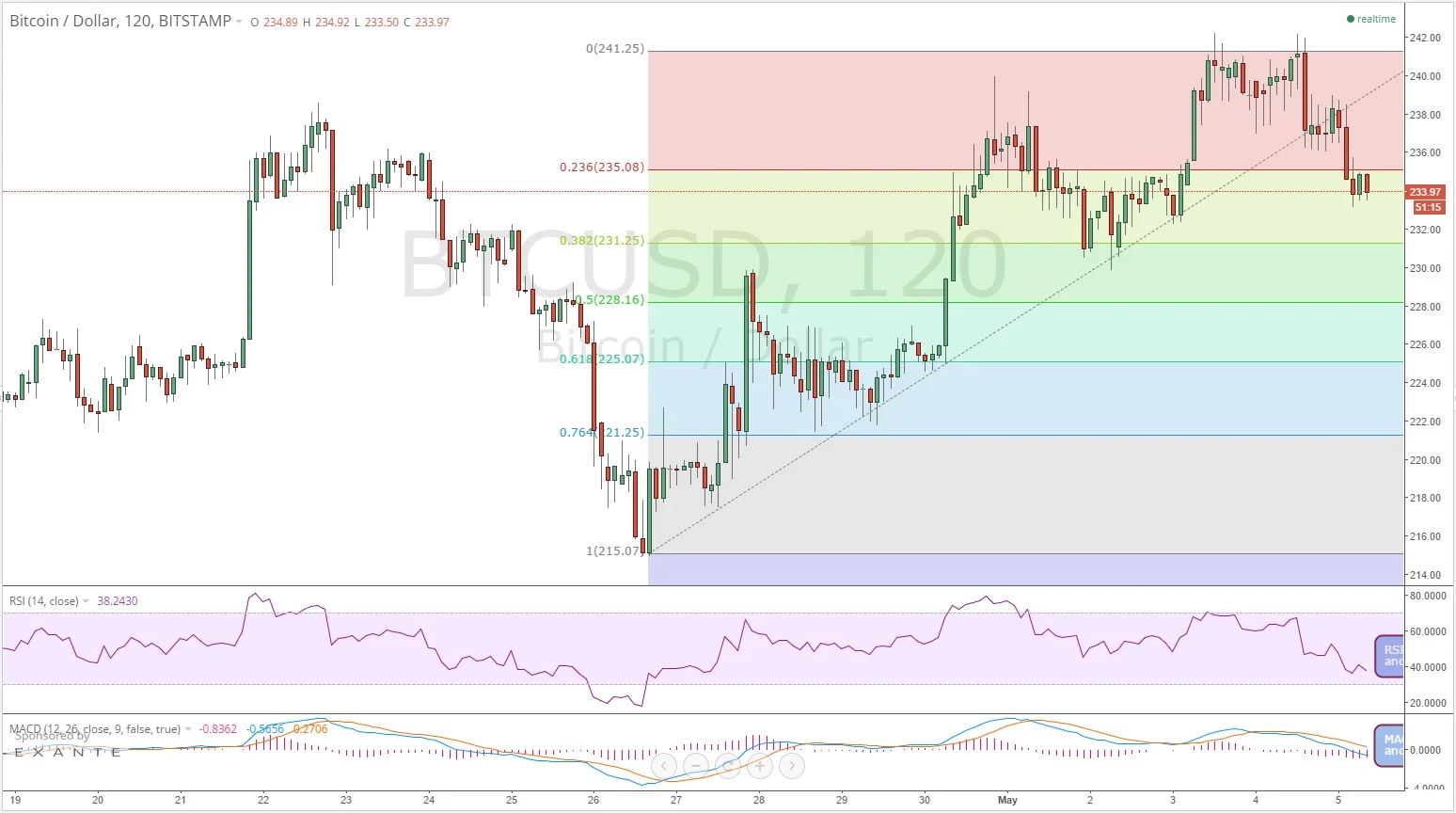

So far the US$220 support level has held, but price has not been able to move to the upside. It looks like it’s consolidating below that ~US$231 level and has been mentioned before the 50 day estimated moving average, which is now ~US$233. The US$220 mark is now providing support. If this doesn’t hold, then the big support area of ~US$210 better.

Long Term

The 1-year (long term) chart for bitcoinCT r: 3 has been and remains bearish. The price remains below all three of its EMAs. The 50 day EMA now sits at ~US$233 and dropping.

All three EMAs are super tight, particularly the 50 (US ~$233) & 100 (~US$244) days as they continue to compress. The Bollinger Bands have started to resolve their tightening after last week’s breakdown and its continuation for most of this week. The y have begun to loosen as price has consolidated at lower levels, which means price has more room for a downside move indicating that US$220 and ~US$210 remain in play. Nevertheless, volatility seems ready to start picking up.

The Relative Strength Index (RSI) looks to have put in a quadruple top a few weeks ago and continues its move lower. It continues making higher lows, which isn’t a good sign either. The MACD (moving average convergence divergence) has remained below the zero line and has been flat for months. This is all while the price sits in this range so if the price begins to move, expect MACD to follow.

Overall, bitcoin volume on exchange continues to be small and shrinking. These are not signs of a trend change.

On Balance Volume (OBV) has been flat for months and is telling the same story as the other indicators, which is that price continues to be in a low volatility and low volume environment. Volume should come in before the next big price move as volume generally precedes price.

Ichimoku Clouds

The 1-year Ichimoku (cloud chart) has broken down. Price has entered from below the bottom of the cloud and now has broken out of the lower bound of the cloud. This is bearish news and more downside price should be anticipated. The ~US$233 mark is now providing big resistance (the lower bound of the cloud) and is at the same level as the 50 day EMA, confirming that this is big resistance.

The cloud ahead has had a bearish crossover as well and is also creating major headwinds for price. This will cause additional pressure on the price.

The Chikou Span (Lagging Line) never entered the cloud, and the Tankan Sen (Conversion Line) and the Kijun Sen (Base Line) have broke down and pierced the lower cloud indicating that lower prices are ahead.

Last week, it was noted that all if all these things happened it would be very bearish for price. This continues to be the case. For further definitions of what is being discussed, please refer to this previous post on Ichimoku cloud charts.

Intermediate-Term Trend

The ~US$230 area didn’t hold and Fibonacci retracements have been drawn from 2 price tops: the mid-November high of ~ US$424 and the mid March high of ~ US$298.

Since the big support area ~ US$230 has been broken, other big support areas can now be identified, which are ~ US$219 and then ~ US$200. This ~US$219-220 has held so far, but will certainly be tested again. Expect major support in the US US$200-210 area. If this doesn’t hold, then price will probably test the lows made in early January.

The RSI topped out a few weeks back and is confirming the price. There are no divergences forming and RSI remains weak. The Money Flow Index is in oversold territory and confirming a lower price move setup.

Included is the Directional Movement Index (DMI), which looks at buying and selling pressures. The blue line indicates buying pressure, the red line indicates selling pressure, and the orange line is the ADX, which indicates the strength or weakness of a trend.

Selling Pressure has risen since last week, while Buying Pressure has fallen. This is consistent with what happened to price since it fell through the ~US$230 support. The ADX has crossed over the Buying Pressure Line last week and has now crossed over the Selling Pressure line at higher levels, initiating a sell signal because this means selling is starting to pick up momentum. This is yet another bearish sign.

The Bollinger Bands were super tight last week and have begun to widen as price has resolved to the downside. This should mean more weakness in price and perhaps a bigger (bearish) move may in the cards.

Short-Term Trend

Looking at the short-term trend (May 24 price high of ~US$240 and June 3 ~US$226) using Fibonacci retracements, last week it was said that “US$235 and US$231 are really big areas and have broken. Price is at its lowest point since hitting the US$240 high. The US$225 and US$221 come into play, but will probably be stops on the way to testing the ~US$210 level.”

Price has broken below all these levels except for that ~US$220 area. This needs to hold. If not, next support is at ~US$219, ~US$217 and massive support at the ~US$210 area.

Big Move Imminent

Bitcoin’s primary downtrend remains intact and all support levels continue to break down on the way to ~US$210. It’s been a slow bleed down but all the indicators in multiple time frames are pointing to a test of key support levels below.

The 50-day EMA and the Ichimoku cloud are very big resistance as price has continuously failed to stay above the 50 day average, nor break through the upper bound of the cloud as the price is now decisively below both indicators.

A retest of the ~US$210 area continues to look like a possibility.