Blockchain and Financial Inclusion: From the Last Mile to the Last Meter

A recent report by Accenture, shows the massive opportunity in banking the unbanked. It estimates a $380 billion annual opportunity for financial inclusion. When thinking about the unbanked and where most are located, there is very little infrastructure and technology solutions trump brick and mortar when it comes to delivering value to the end user. There is no branch banking and this truly is at the edge of wireless. If existing financial services companies and banks want to grab these end customers (which they do), solutions that comprise mobility, identity & security will be necessary. I believe a big part of this solution can be blockchain(s).

In this article, a blockchain network will be defined as a secure, low cost payment rail for moving assets peer to peer over the internet. These assets are more than just bitcoin (which will be explained in detail below) but rather any assets that have value and therefore these blockchains are permissioned/distributed/consensus as well.

The Features of a blockchain network are as follows:

- It's peer to peer: assets transfer directly between the parties who control the assets.

- It doesn't need a bitcoin currency: the networks are built for specific markets and can issue and transfer any asset.

- No Mining: transactions are ordered by trusted parties that form a federation.

- Very fast: confirmation happens in seconds not minutes.

- Scalable: 1000s/sec (transactions)

This article presupposes that existing financial institutions will be a major part of the solution involved in tackling financial inclusion and that permissioned ledgers will be what they use because of the censorship resistant nature of the bitcoin blockchain. The complexity of regulation imposed on banks means within the network all parties must be known and trusted. Other issues which are beyond the scope of this article include settlement, anonymous global miners and increasing likelihood of 51% attacks as more and more assets are available. Distributed ledgers will facilitate getting to end customers whom are unbanked (as a major new revenue stream) in a mobile, branchless banking world and bring major benefits for both financial institutions and customers. I believe this opens up mobile banking to fast peer to peer asset transfer using private and public blockchains, without the need for traditional financial and physical banking infrastructure.

The Opportunity

According to The Global Findex, there are still over 2 billion people unbanked globally. 46% of adults in developing countries are without a basic account, while 50% of women do not have an account. The chart below shows the giant revenue opportunity for the 12 countries that stand to benefit the most from financial inclusion.

Note: China and Indonesia are not represented on the above Accenture chart but are massive opportunities as well: 21% unbanked in China and 64% in Indonesia.

The chart below shows the world's unbanked by region.

Huge areas of the world remain unbanked with billions of dollars in revenues untapped for the players who seize this opportunity.

Mobile Is Eating The World

For the first time in history, technology, particularly mobile technology is making it possible to reach many of these places. Mobile technology plus mobile banking with the use of blockchain technologies for financial inclusion can allow value transfers happen B2C, B2B, and P2P. Mobile is the preferred banking device for the developed world as the chart below shows. Mobile + Blockchain allows the "Last Mile" for financial inclusion to become the "Last Meter".

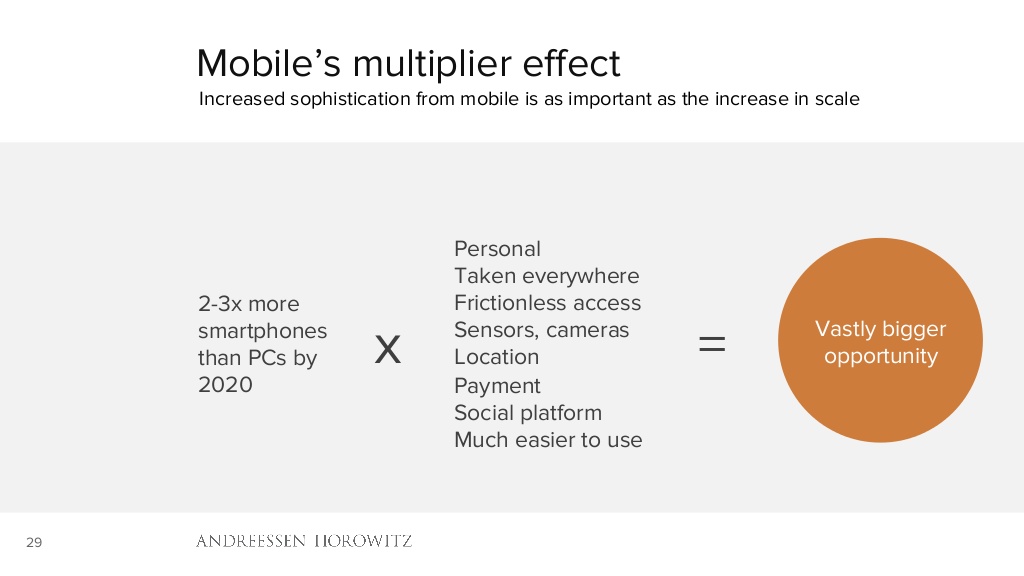

Benedict Evans' presentation, "Mobile is Eating the World", provided a glimpse into how dramatically mobile has scaled and how it will continue to do so, ultimately becoming the device of choice for the entire world for most activities, including social and financial.

Why Blockchains Make Sense for Financial Inclusion

According to Santander, their analysis suggests that distributed ledger technology could reduce banks’ infrastructure costs attributable to cross-border payments, securities trading and regulatory compliance by between $15-20 billion per annum by 2022.

This is important because banks are cutting back on costs and going branchless but want reach at the edge of wireless. There is a massive customer base to connect to via mobile. Blockchains can cut operational costs yet allow for reach of the whole customer experience not just bank accounts. Bank accounts become the gateway to all types of asset transfers and allow for capturing the customer within an ecosystem.

International payments remain slow and expensive. Significant savings can be made by banks and end users by bypassing existing international payment networks. Storing transactions in one automatically shared, tamper-proof database could eliminate the need for complicated procedures and clearinghouses now used to make sure banks have their records in sync, saving time and money and reducing the risk of error. Without middlemen, payments and settlement can happen rapidly allowing people access to their capital when they need it. Think of how this can impact villages and entrepeneurs in the developing world. The allowance of frictionless savings and investment gives people more control over their financial destiny. Settlement times and costs can be reduced dramatically and a distributed could support large amounts of small transactions (microtransactions) within a trusted network.

For banks, blockchains will allow for the most efficient uses of capital in history. They can lower the amount of capital they are required to hold. Let's call it "Just In Time Cash". Right now banks have to hold a capital requirement as insurance for incoming and outgoing payments that are "in process" from other banks and existing infrastructure. This is driven by an inability to see in real time the liquidity position of an organization and its upcoming commitments, its inflows and outflows, especially from a risk scoring perspective. This inability results in need to hold more funds in reserve. Blockchains provide an opportunity in providing greater transparency to enable regulators to be convinced that higher reserves are not required, and an institution that has this insight may be able to operate with lower reserves, especially if it can switch its portfolio rapidly.

Distributed ledgers support "smart transactions". These include smart contracts, transactions that include multiple assets, transactions that include multiple parties and 2 way transactions. Think about this when thinking of financial inclusion. This will cause an explosion in tradeable assets globally and allow the unbanked not only bank accounts but access to global capital markets by allowing for all types of value transfers. It also allows for better property records in emerging markets, where these are essentially non existent right now. Dispute settlement on all types of assets through contracts and legal services increasingly tied to code can be linked by a blockchain. Trade will go up exponentially locally and over distances because of unbreakable escrow or programmatically designed smart contracts. Local economies can become more dynamic and flourish.

The Reasons For Not Having An Account

This section will discuss the hurdles that are faced today in trying to get a bank account and how blockchain + mobile tackles these problems.

Reasons for not having an account:

- Identity: A mobile phone can provide this through an independent token or security element or biometric.

- Regulations: This is jurisdiction dependent, but flexible strategies are being used to help the cause of financial inclusion. Tiered AML/KYC schemes that rely on digital. Changing some of the prerequisites for credit history and microtransfers for low income individuals.

- No Banks: Mobile + Blockchains with an identity element allow for banks to reach where there are no branches.

- Cash instead of digital payments: Governments and NGO's and the private sector are working to digitize money. The trend is heading in this direction.

- High costs and fees: Using a blockchain and getting rid of middlemen should mitigate these fees dramatically. Fintech companies are already slashing the cost of payments and remittances as well as the traditional players. This should leak into all assets as the technology is built out.

Distributed Ledgers as part of the Infrastructure for Financial Inclusion

Distributed ledger technology as the underlying infrastructure in a mobile, digital world is compelling. It also allows for customization depending on the region and their unique ways of transacting and settlement. It also becomes a two way street where efficiencies with the banks becomes wins for the end customer and vice versa. Ultimately this allows banks to become technology companies where automated, paperless and super fast systems provide the backbone to getting customer reach, without all the traditional man power and departments/divisions needed for permissions.

Building an ecosystem does not happen overnight but looking at what architecture banks and startups can use to reach end customers and bring them into the financial system and access global capital markets, leads one to believe this is a use case. The internet of money is truly on its way.

For a presentation I did for the Wall Street Blockchain Alliance (WSBA), please click here.