A Deflationary World: The Future For Consumers & Corporations

The boon that was Globalization, coupled with an era that has seen the most rapid advance of technological innovation in the history of civilization, opened up the barbarian gates: the world was flooded with cheap labor and cheap goods and thus the era of deflation was ushered in. Simply put, we live in a deflationary world.

The implications of this for the developed economies has been transformational and continues to be. The ever evolving pace of technological change has spilled over into all aspects of the global economy and covered the world in a blanket of deflationary signals. Cheap and oftentimes remote labor as well as cheap goods globally have lead to secular shifts in the jobs market in which many people have found themselves on the wrong end of history.

Technology doesn't cycle it accelerates. Companies like Uber and AirBnB (the sharing economy) have led to a drastic re-think of what actually "work" and "employment" really are. The sharing economy has become a deflationary force and the companies behind it have found ways to shift costs off their corporate balance sheets (by not labeling employees full time workers) and shaking up industry incumbents while driving the price of services down. The rise of mobile has given the world access to information and services. Software and mobile are truly eating the world. The disruption of every industry is finally here.

Banking and financial services are the latest victims of this. Fintech companies have put enormous pressure on the banks and caused them to face deflationary pressures. There are three areas which have been greatly affected by this technologically driven deflationary world (while it is pertinent to the unbundling of banking it applies to all industries):

- Price transparency

- Pricing power

- Efficiency

Banks have had a rough go in recent years and are finding it harder and harder to discover additional revenue sources at a time when their regulatory and compliance costs have skyrocketed and forced them to exit some core businesses. This comes at a time when fees charged to clients have dropped and clients are leaving for alternatives. The fintechs are putting pricing pressure on all banking businesses. One answer for banks to these problems is distributed ledger technology. As has been written in other blog posts found here, here, and here, distributed ledger technology has many benefits for banks:

- cost avoidance (getting rid of middlemen as well as backoffice/employees; going paperless)

- reducing capital ratios

- reducing risk

- improving regulatory compliance

- reducing redundancies and get rid of operational and functional silos

In the initial phases of the rollout of distributed ledger technology it will not be revenue producing for banks but cost reducing. There are two ways to improve your balance sheet by increasing revenues or reducing your cost of goods sold. Banks are in desperate need of improving their balance sheet, hence why this technology is extremely valuable to them for achieving these goals. The distributed ledger is banking's answer to the shared economy and allowing them to become more technology focused companies.

Meanwhile the current "economic recovery" has been uneven at best and quite frankly, most feel like it has not happened at all. While the cost of goods have fallen, which means you can purchase more for less, wages have not increased in any meaningful way since 2009. In fact, certain inputs have seen inflation: medical care, real estate (rent also), food and education. In many cases, income levels have not kept up with these costs. This is a low cost, low return world and will be for some time to come. Below is a series of charts which show the signs of deflation and how it has affected the consumer, the corporation and the global economy.

One of the biggest problem has been wage growth and job growth. Consumers have less disposable income and this has given rise to companies that offer low cost alternatives to provide services to these consumers. This has led the price of services and goods to fall. Companies have felt balance sheet pressure and shifted operations offshore to low cost labor centers to produce these lower cost goods.

With wages not increasing, the workforce participation rate has dropped dramatically:

One of the reasons for this according to a recent study is because most of the jobs created have been for high wage earners (the most highly skilled) and low wage earners (the underemployed) those left in the middle have been phased out of the workforce or have chose to leave it.

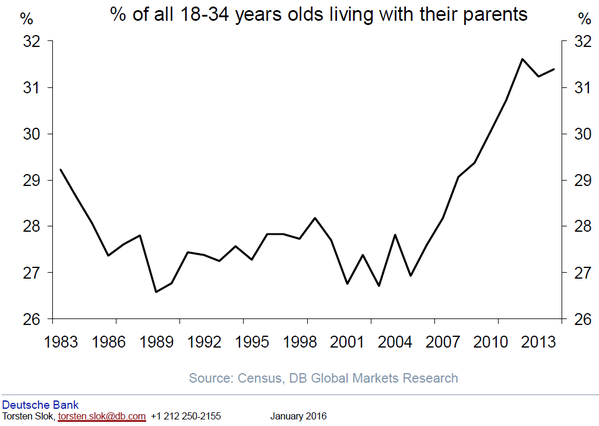

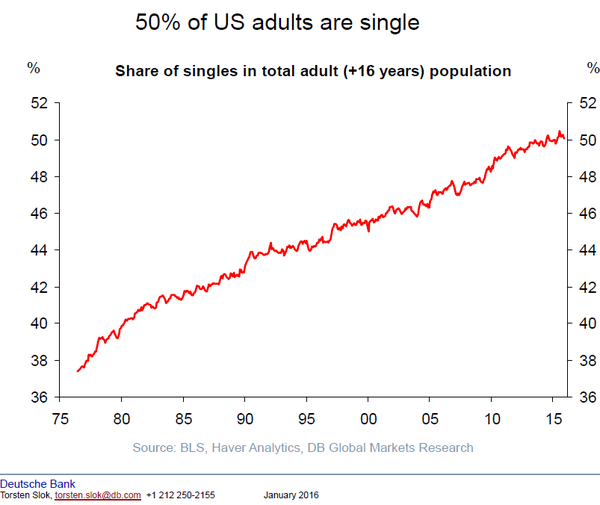

This had led to some serious shifts in the lifestyle patterns of those most affected by the recession. This is what happens when you make less money or are underemployed.

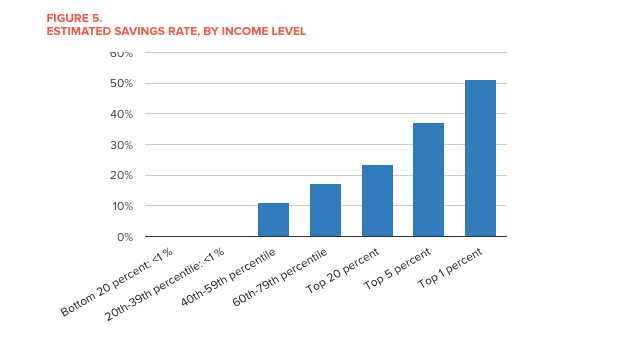

Young people have not been the only ones who have been affected. Older people who have suffered through two bubbles and lost a lot of their retirement savings have been forced to work longer or are retiring in poverty. This will have big implications for already highly indebted governments and their future spending and taxation plans. The highest wage earners also saved the most while wealth inequality has increased dramatically. These distortions are having major effects on the composition of todays workforce.

This has taken its toll on corporations who are dealing with a cost-constrained world. Seeking new revenue streams is more challenging that ever, particularly for banking and financial services. This deflation theme has led corporations to be involved in record breaking Mergers & Acquisitions. Many of these have been cost cutting synergies, rather than revenue accretive. They are looking to take every cost they can possibly find off of their balance sheets.

This also applies to earnings growth which has not been expanding. Instead most of the growth has come from corporate buybacks, multiple expansion as a result of zero interest rate policy and dividends. Revenue growth has been poor.

This is how it has played out in the real global macro-economy. Interest rates have been at extremely low levels so anyone saving money in a bank or looking for income has not been able to generate significant returns on their money. This has led to shortfalls and has caused standards of living to drop for those reliant on return. The chart below shows the yield on the 10 year US treasury note going back to 1980. The yield is near all time lows.

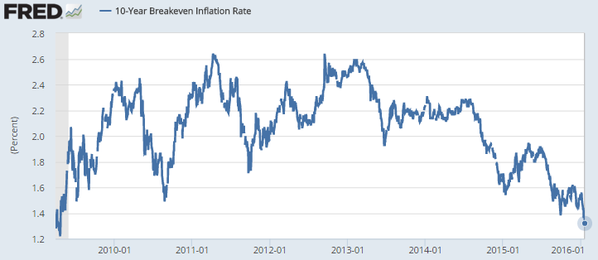

Inflation expectations 5 years and 10 years out are near lows not seen since 2009 and the financial crisis. This has been driven by a slowdown in economic growth and a massive decline in the price of commodities. In fact, commodities are at their lowest levels since 1990.

This is not just a U.S. problem, Europe and the rest of the world are seeing a lower rate, lower return environment.

A perfect example of deflation from technology can be found in commodities, specifically oil. While some blame China and the global slowdown for the fall in oil prices, technology in the form of fracking has led to extremely efficient ways to find oil in places it could never be drilled. This led to an oversupply of oil and gas which led to the huge drop in price.

In this type of environment, corporations and consumers are both looking to cut costs as much as possible and technology has helped both to achieve this goal. This post barely touches on the results and real implications of a deflationary world, and how technology is accelerating this new reality. As we will discuss in future blog posts, this environment is potentially unlike anything we have had to deal with in modern world history. Its implications are real, and will have impact across all aspects of the global economy for generations to come. Those governments, corporations, and individuals, unprepared for these new realities will ultimately find themselves in a situation where they don't have a strategy to remain both competitive and relevant.